The talk of rising council tax bills is becoming a reality for millions across the UK, as recent reports suggest that the average household could see an increase exceeding £100 next year. Such a development demands urgent attention, analysis, and a deeper understanding of what this means for ordinary citizens, local governance, and the economic landscape of the nation.

The proposed rise in council tax bills is more than just a minor administrative adjustment—it signals a shift in the financial responsibilities of local councils and the everyday people they serve. For many families, an extra £100 or more obligation can signify the difference between financial comfort and distress, especially amidst a backdrop of rising living costs and economic uncertainty.

So why exactly is this happening? The reasons are complex but largely center around funding shortages for local services. Councils have long been grappling with budget cuts and increased demand for services, and a higher council tax seems to be the proposed solution to bridge funding gaps.

Local communities bear the brunt when council tax bills rise. The immediate impact is financial strain on household budgets. However, the broader implications permeate various dimensions of community life. Social care, education, transportation, and housing are all sectors that rely heavily on local funding.

Without adequate revenue, councils face tough decisions—cutting services or inconveniencing taxpayers with higher bills. While some argue that higher taxes are necessary to maintain service levels, this perspective overlooks the financial stress that increased taxes place on low-income families and the broader societal impacts of widening economic disparity.

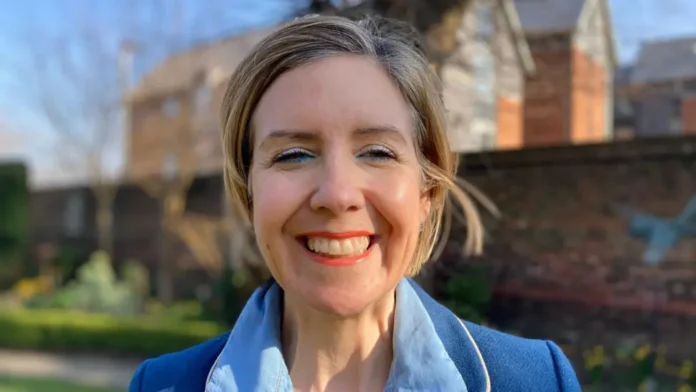

As these financial debates rage, all eyes turn to political leaders for guidance and action. Keir Starmer, leader of the Labour Party, has voiced his concerns over the rising costs faced by ordinary citizens. Starmer’s position reflects a growing recognition of the unsustainability of continuous tax hikes on households already struggling to make ends meet.

The Labour Government argues for a more balanced approach, emphasizing the importance of national government support to local councils. By advocating for increased central funding, Labour aims to alleviate the financial woes of councils without disproportionately burdening citizens through excessive tax rises.

Starmer’s stance also questions the efficiency and fairness of the current fiscal policies, calling for a reform that supports economic equality. This approach is rooted in the party’s broader policy framework, which seeks to integrate social justice with economic policy, ensuring that financial burdens do not disproportionately impact those most vulnerable.

The proposed rise in council tax bills doesn’t exist in a vacuum; it must be understood within the broader political landscape of the UK. The governing Conservative Party faces criticism from opposition groups who argue that their spending cuts and fiscal policies have contributed to the funding crisis at the local level.

Debates about public spending versus tax rises hover over this issue, reflecting a long-standing ideological divide between economic conservatism and progressive social policy. While Conservatives typically prioritize fiscal austerity, Labour aims to bolster public investment as a means of economic stimulation and social welfare enhancement.

Navigating these ideological differences is crucial as policy decisions not only affect current financial conditions but also shape the future political terrain.

Possible solutions to the council tax dilemma extend beyond simply adjusting current rates. A comprehensive review of local government funding is necessary to ensure that councils have the resources needed without imposing severe financial pressure on residents.

One such proposal involves reforming the distribution of funds between central and local governments to create a more sustainable financial ecosystem. Additionally, introducing targeted relief for low-income families could mitigate the impact of tax rises and promote more equitable financial responsibilities across different socio-economic groups.

Moreover, careful investment in efficiency-driven practices within local councils might reduce operational costs and optimize resource allocation, potentially offsetting the need for high tax rates in the long term.

The forecasted rise in council tax is more than a mere fiscal policy alteration; it’s a wake-up call that demands immediate collective action. Citizens, local councils, and national governments must engage in dialogues aimed at creating fair, effective, and sustainable financial practices.

Keir Starmer and the Labour Government undeniably play a central role in championing policies that balance fiscal responsibility with social welfare. As policymakers, their obligation is not only to critique existing proposals but to offer tangible solutions that alleviate rather than exacerbate financial hardship for ordinary citizens.

Whether through advocating for increased central funding, reforming inefficient fiscal practices, or pioneering innovative funding mechanisms, a multi-faceted strategy is necessary. Only through collaboration and proactive policy-making can the UK navigate the complexities of local taxation and ensure a fair financial future for all its residents.